June 10th - Release Notes

Engineer Mobile/WorkApp Updates

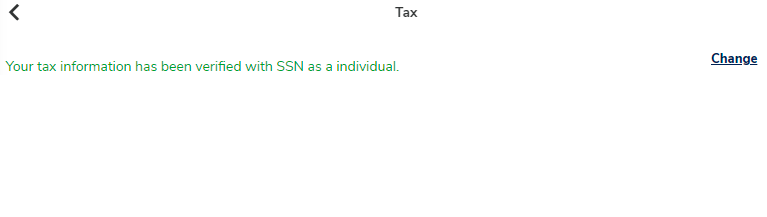

Tax Information

The US engineers can now easily modify tax information from the Profile-Tax section.

If both Tax information and documents were submitted earlier, engineer can now change the type of tax reporting/filing from Individual - Business, Business - Individual, Individual - Individual, Business - Business if required.

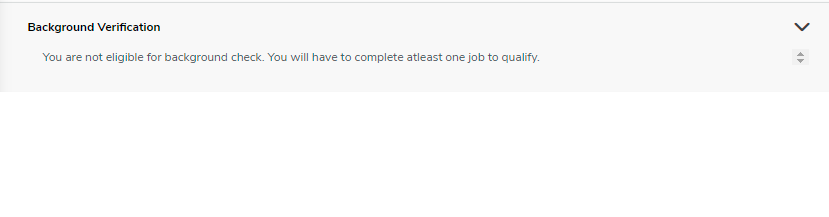

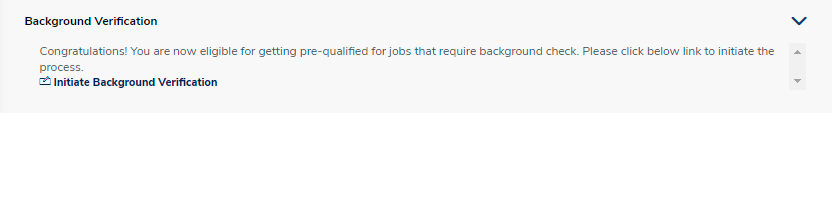

Background Verification

Background check feature is added for Canadian, Australian and European countries' engineers. Under Profile section Background Verification option is provided where the engineers will be eligible to initiate the background check process only after completing their first job.

After completion of the first job, there will be an option to initiate background verification. Background verification will allow pre-qualification for qualified jobs.

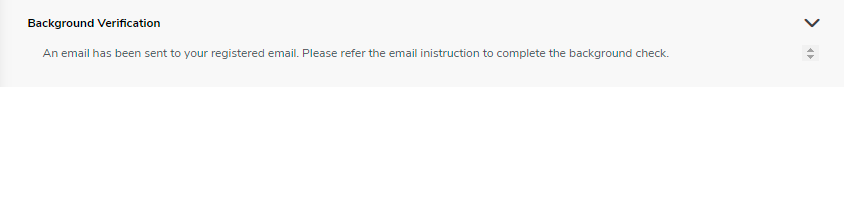

After initiating background verification, an email will be sent to the registered email address with instructions.

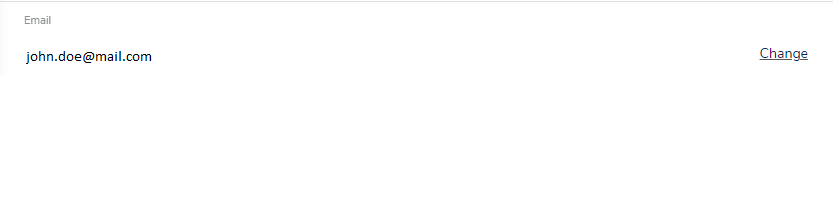

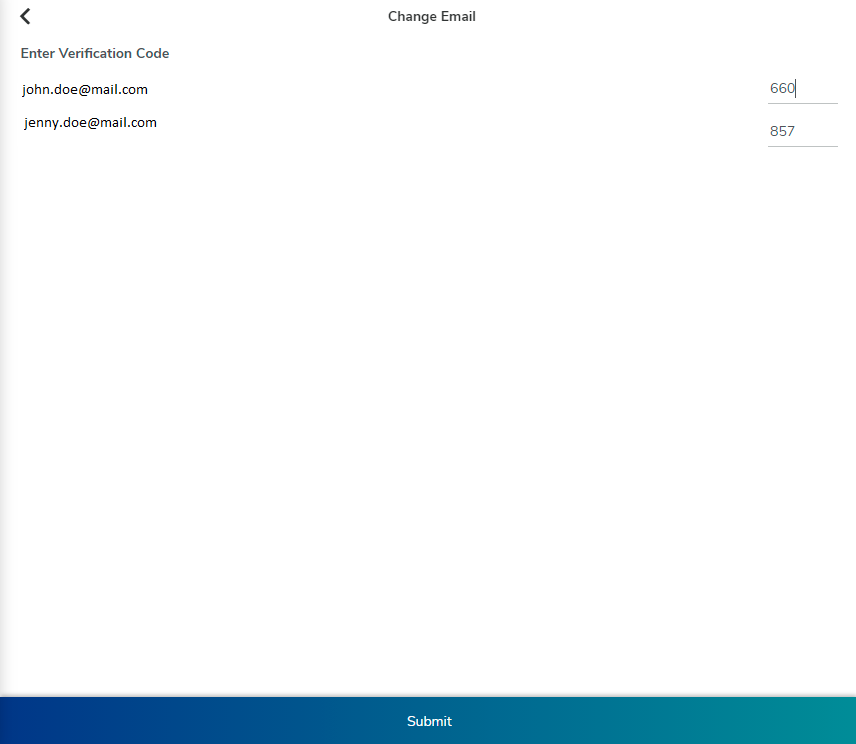

Updating Email

All engineers are now provided with an option to update their email address. Under Profile Information, on editing the About section engineers can find the change button to update their registered email address.

STEP 1:

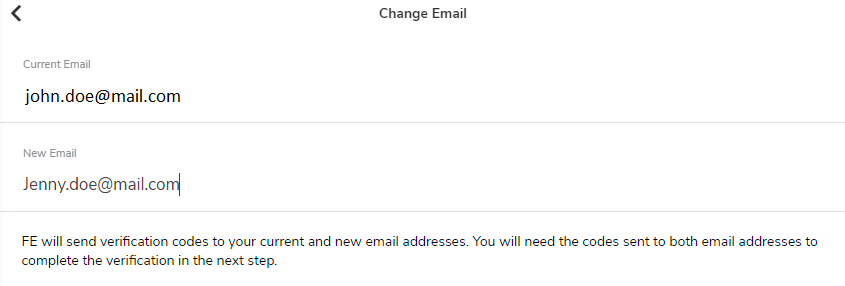

STEP 2:

STEP 3:

In case of any issues please contact FE Customer Support.

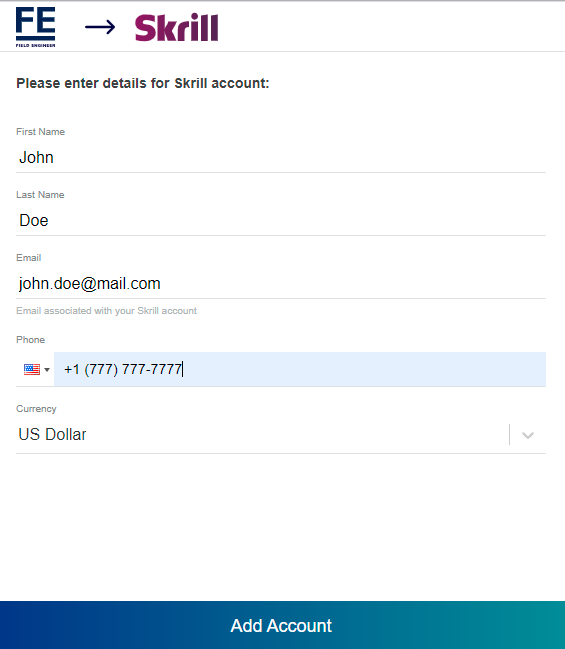

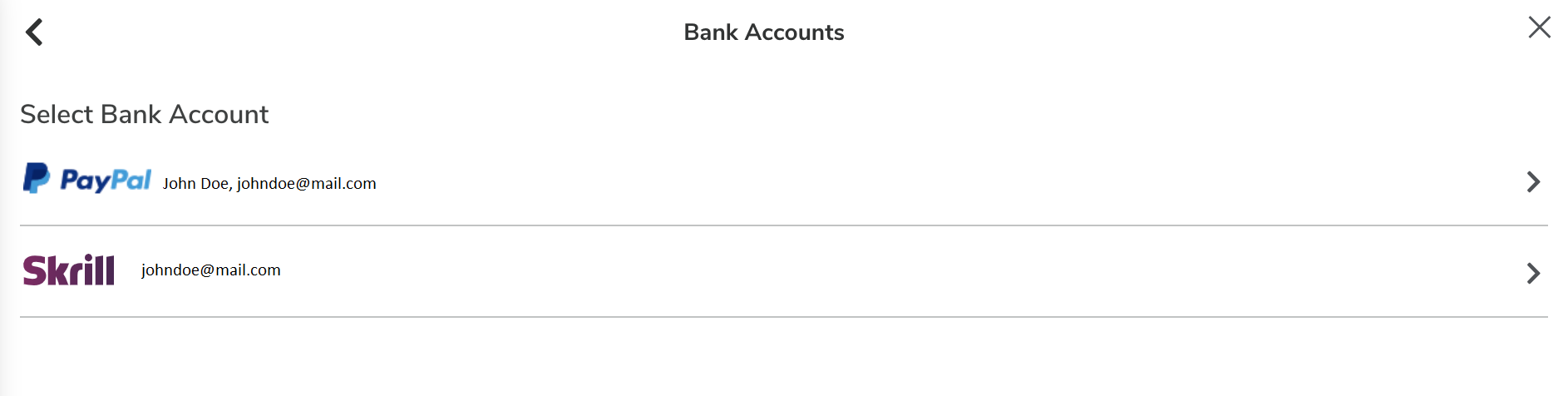

Payment Method

The engineers are provided with new additional payment method Skrill through which they can withdraw the funds.

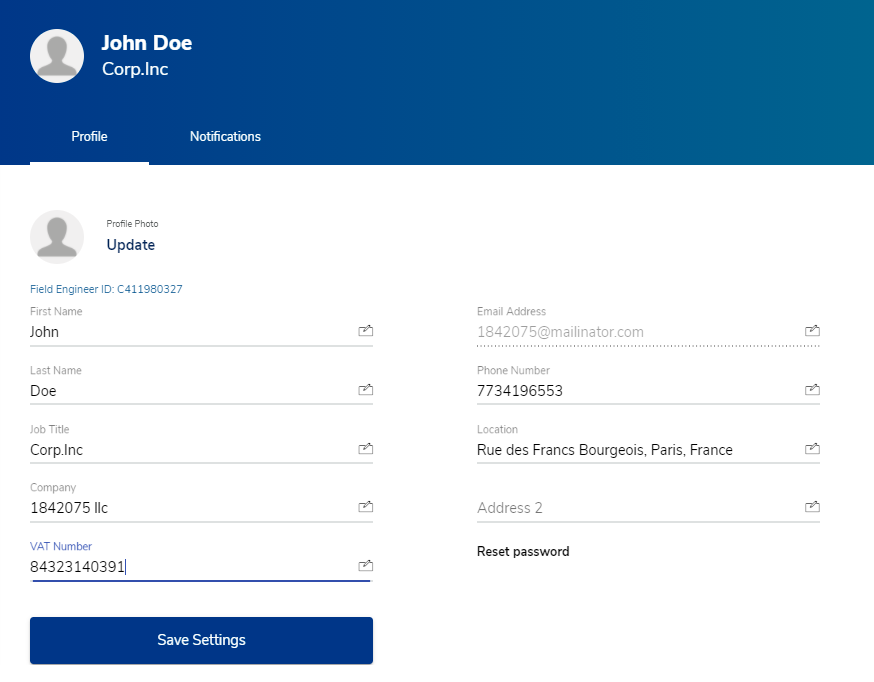

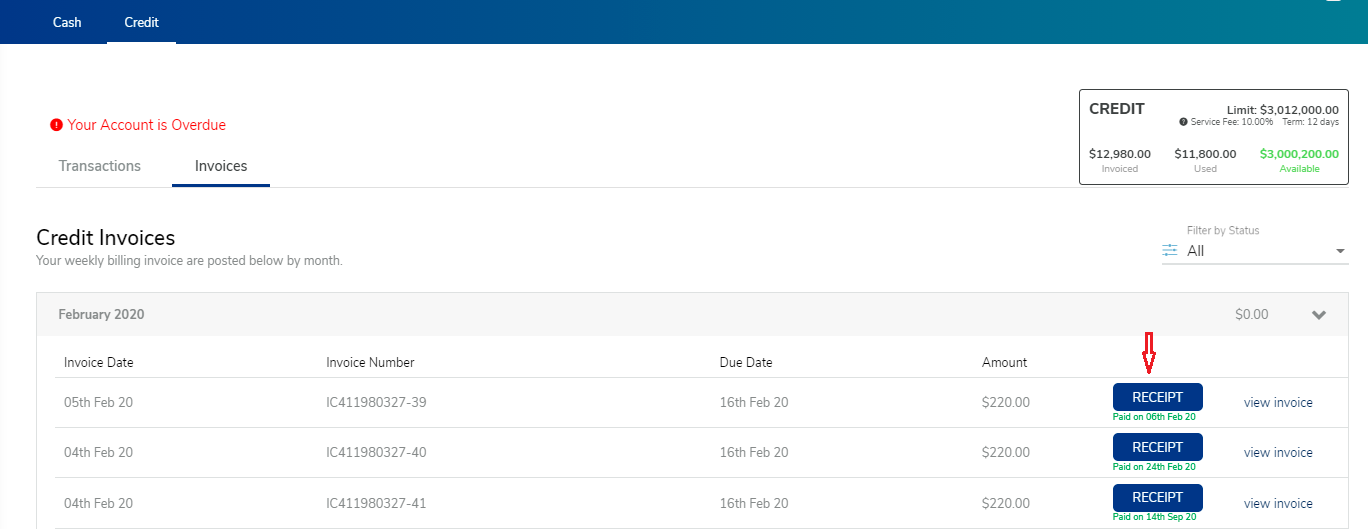

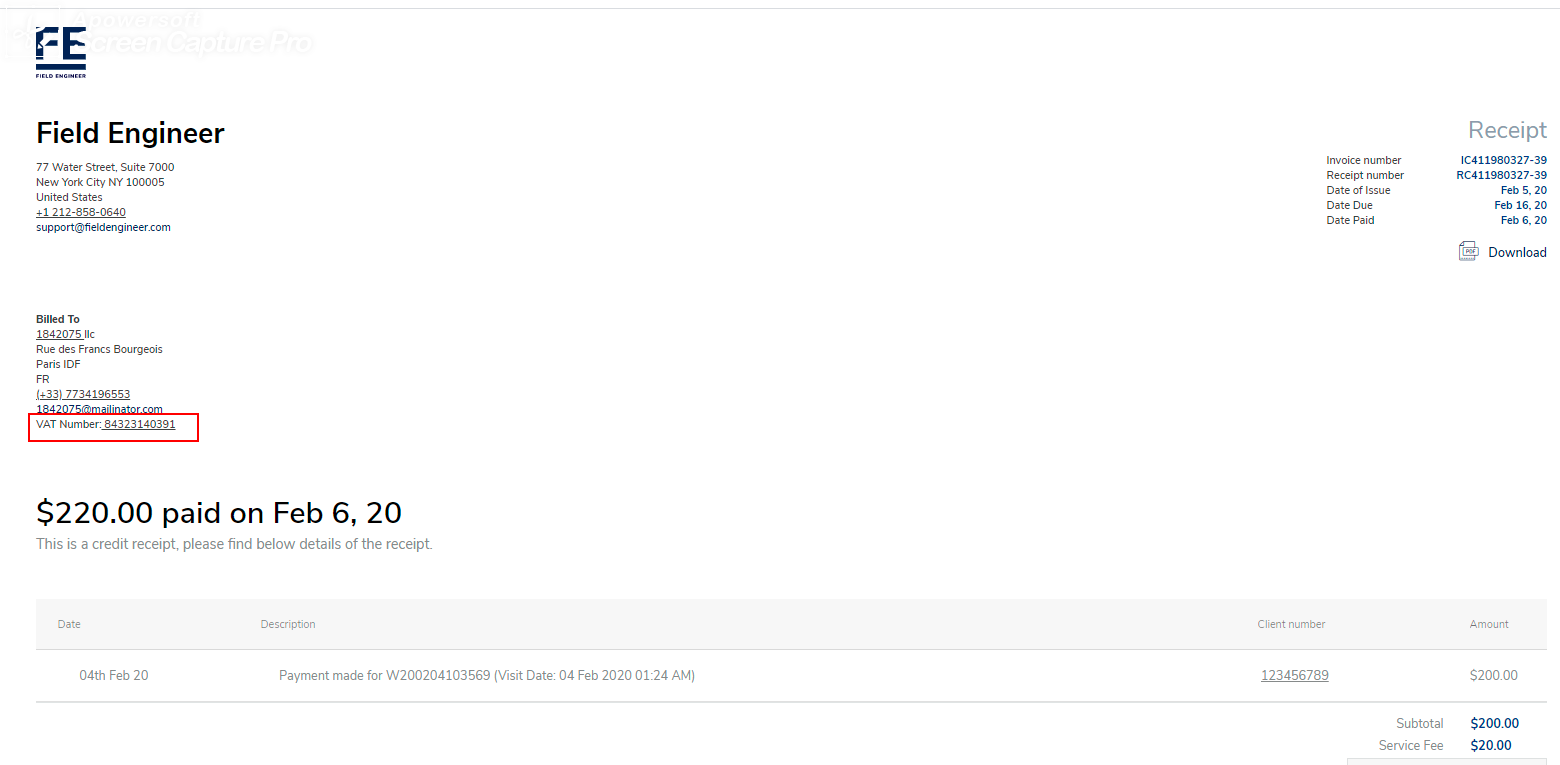

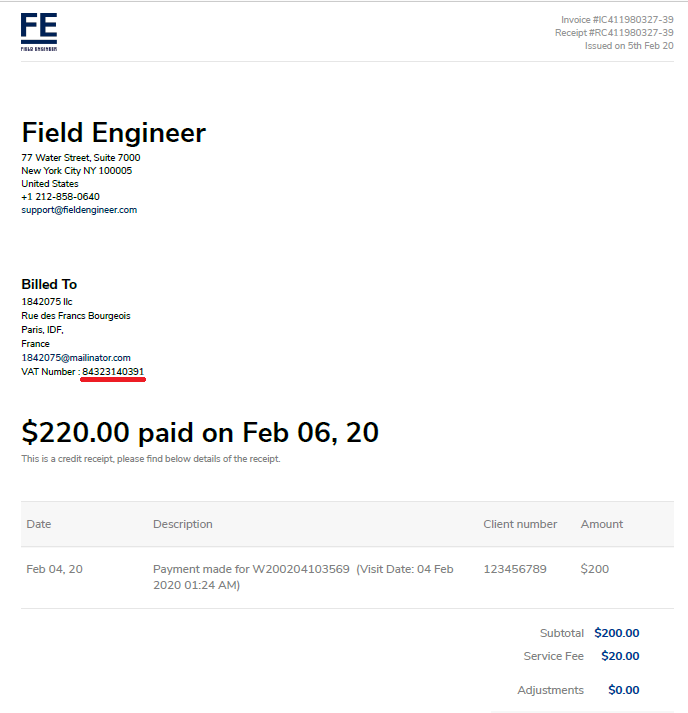

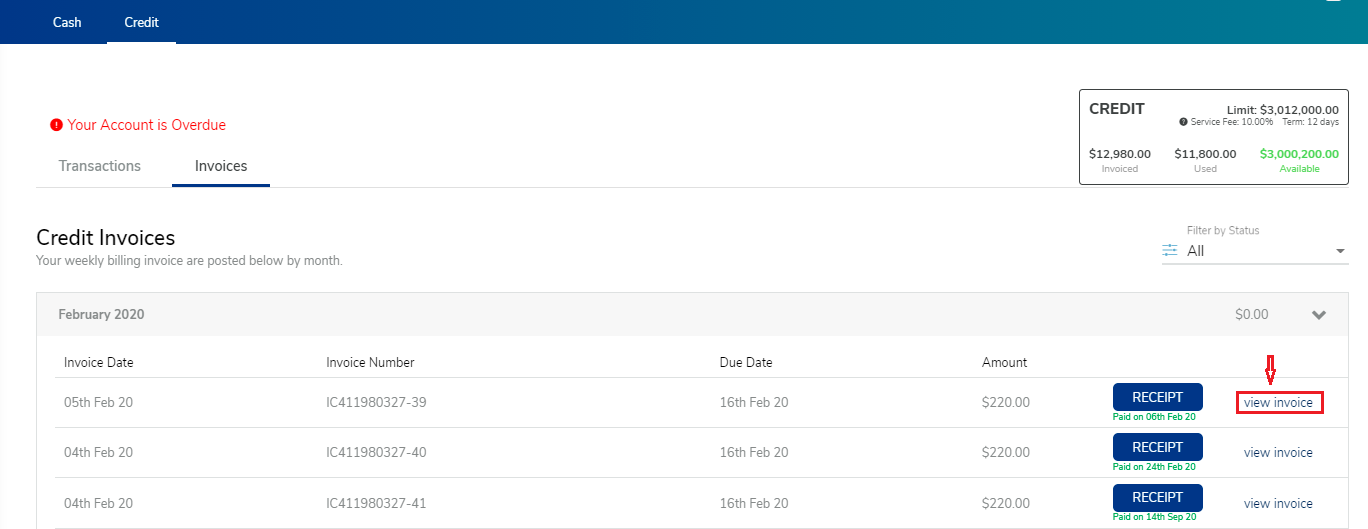

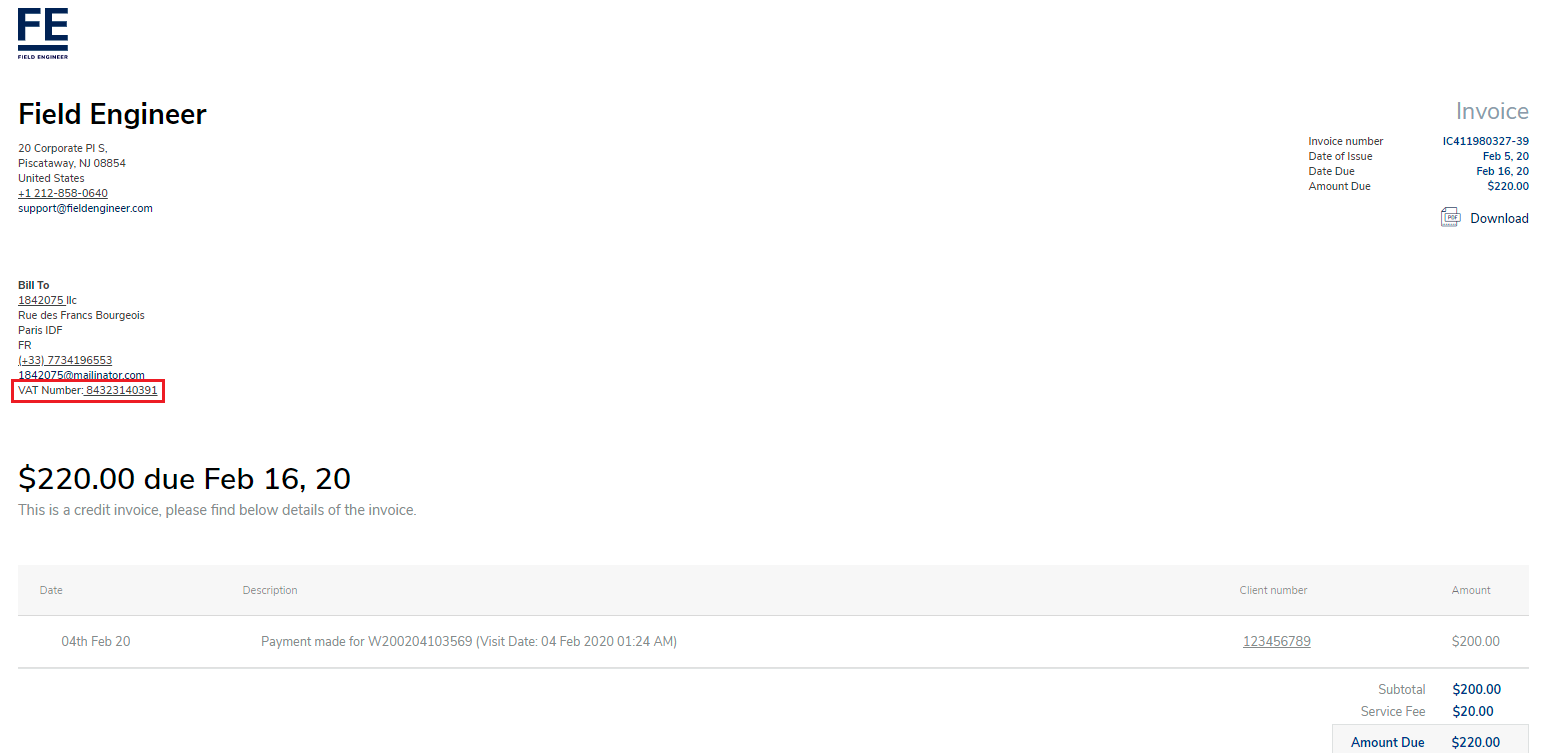

European Countries Business Users - VAT Number

For European countries VAT number/VATIN (Value added tax identification number) can be populated for job receipts and invoices.