July 1st - Release Notes

Engineer Mobile/WorkApp Updates

Tax Center/Earnings

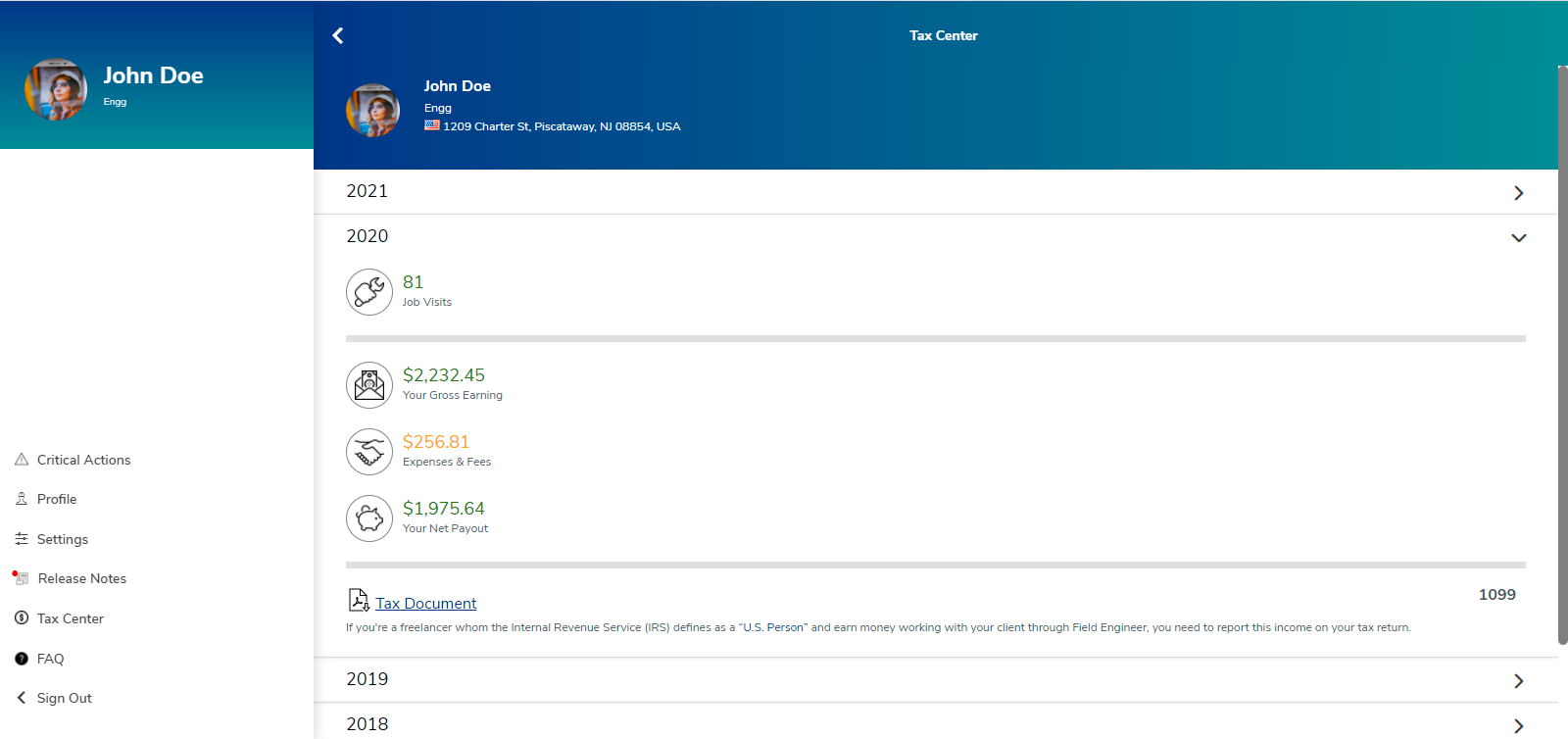

US Engineer can now report his earnings to the IRS with 1099 form available under Tax Center.

For US Engineer, under left menu Tax Center option is provided where list of years starting from 2016 are provided. Clicking each year provides following information if he had worked on jobs for the selected year: Job visits, Your Gross, Earning, Expenses & Fee, Your Net Payout, Tax Document 1099 pdf if his/her net payout is $600 and above.

Tax statement for year 2021 will be generated next year.

For US Engineer with net payout for selected year is less than $600 Tax-document 1099 is not generated but can see other details on jobs worked.

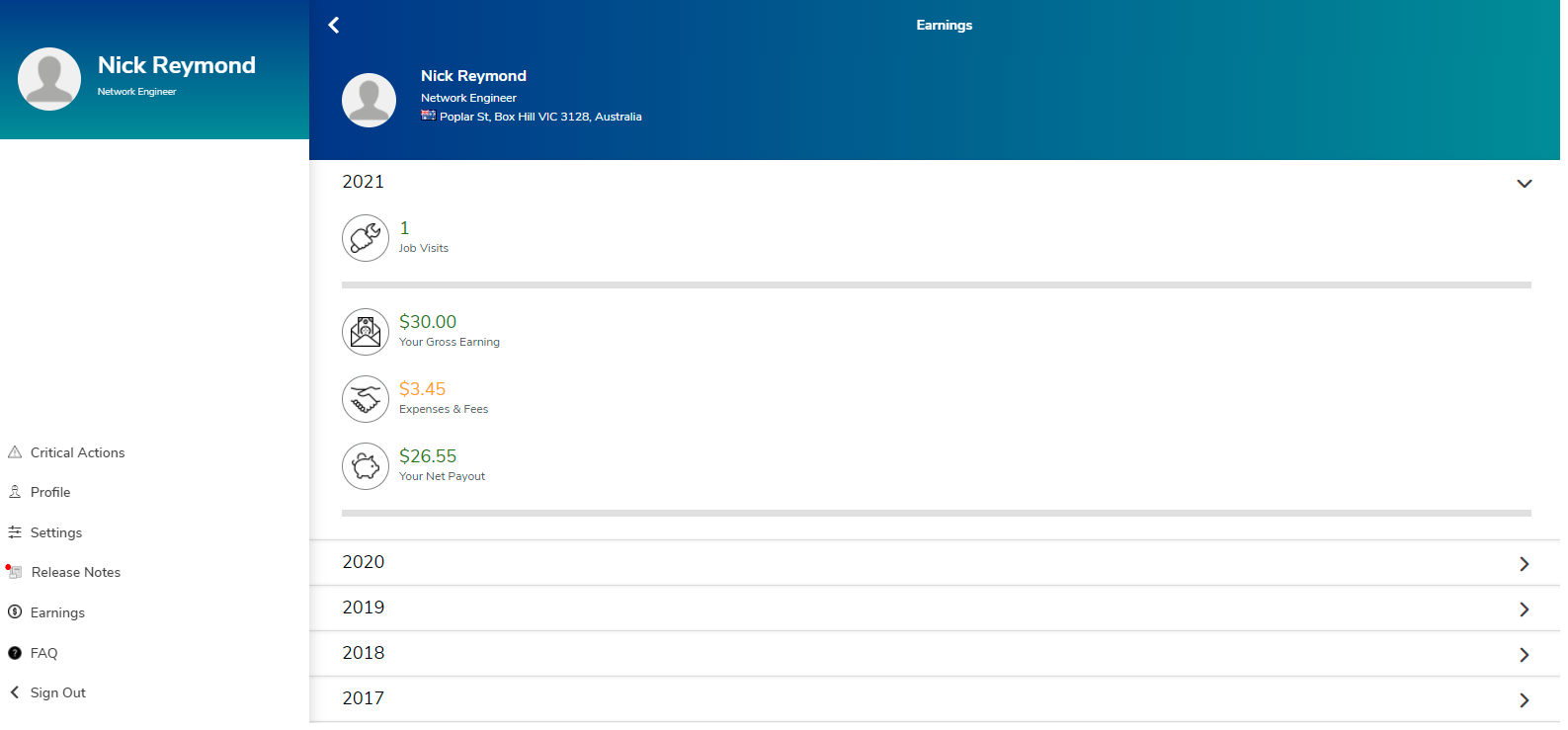

Similarly the international engineers sees Earnings option in the left menu. And can see the Job Visits, Your Gross Earnings, Expenses & Fees, Your Net Payout for the selected year but Tax Document will not be available.

For Private engineers and Sub engineers, cannot find Tax Center/Earnings options.

Application New Version Indicator

When there is a new version available for Mobile/WorkApp and the user is using the older version, a red indicator is shown on the Release Notes option in left menu. On clicking on Release Notes with the indicator on it, the application will be updating to the latest version.

Engineer Resend Code functionality for Email Update

The engineer is now provided with an option Resend Codes if the previously sent validation codes have expired.

The validation codes will expire every 15 min. Then you could use the Resend Codes option available in the validation codes screen/page to get the new validation codes again.

Engineer is not allowed to update email address more than once i.e. you can not change to an other email if you have already initiated one. If need to update email again then can reach out to FE Customer Support.

Engineer is not allowed to use previously used/registered email address with FE for email update.